Tax brackets 2022 calculator

Under 65 Between 65 and 75 Over 75. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

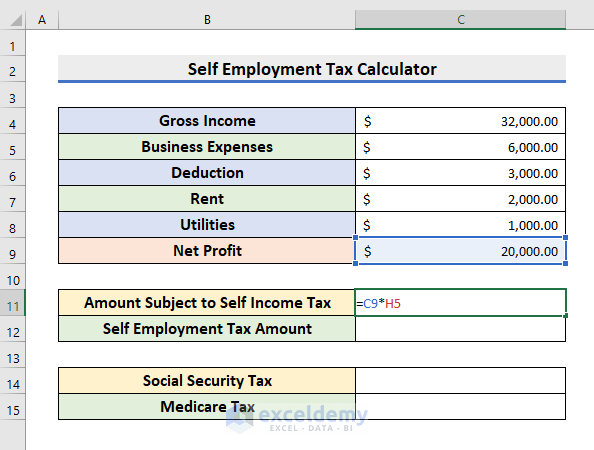

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Calculate your total income taxes.

. In the section we publish all 2022 tax rates and thresholds used within the 2022 Malaysia Salary Calculator. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax.

Calculate the tax savings. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Calculate your combined federal and provincial tax bill in each province and territory.

The next six levels. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Updated for 2022 tax year.

Daily Weekly Monthly Yearly. 10 12 22 24 32 35 and 37. The 2022 Tax Calculator Uses The 2022 Federal Tax Tables And 2022 Federal Tax Tables You Can View The Latest Tax Tables And.

The calculator reflects known rates as of June 1 2022. The Tax tables below include the. Federal California taxes FICA and state payroll tax.

As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022. Ad Browse discover thousands of unique brands. The Income tax rates and personal allowances in South Africa are updated annually with new tax tables published for Resident and Non-resident taxpayers.

Nairobi Water Bill Calculator. 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory. Please enter your salary into the Annual Salary field and click.

Complete Edit or Print Tax Forms Instantly. Personal tax calculator. The current tax rates 2017 consist of 10 15 25 28 33 35 and 396.

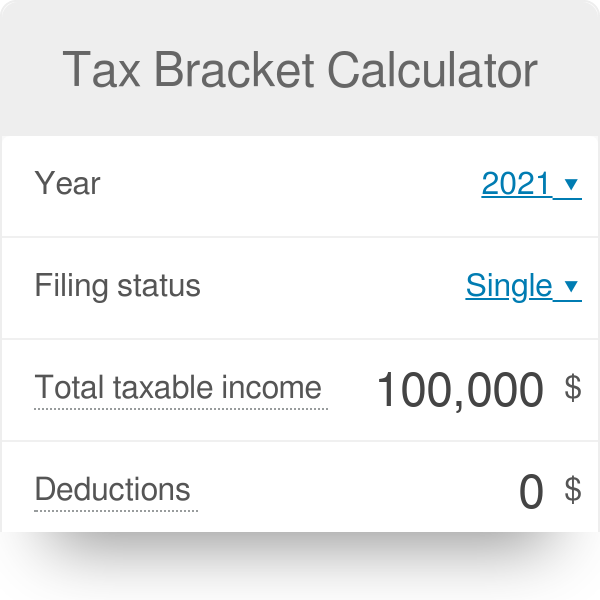

And is based on the tax brackets of 2021. The lowest tax bracket or the lowest income level is 0 to 9950. Ad Access Tax Forms.

Tax rates range from 0 to 45. It is taxed at 10 which means the first 9950 of the money you made that year is taxed at 10. See where that hard-earned money goes - with Federal Income Tax Social Security and other.

Ad Tax Preparation Services Ordered Online In Less than 10 Minutes. Pricing Starts At 97. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

This simplified will calculate your annual monthly fortnightly and weekly salary after PAYG tax deductions. Remove IRS Tax Liens. Read customer reviews best sellers.

As of 2016 there are a total of seven tax brackets. Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF and NSSF Contribution. This means that if you are aware of a 2022 tax exemption or 2022 tax allowance.

Your bracket depends on your taxable. 100s of Top Rated Local Professionals Waiting to Help You Today. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

There are seven federal tax brackets for the 2021 tax year. 2022 free Canada income tax calculator to quickly estimate your provincial taxes. Our Resources Can Help You Decide Between Taxable Vs.

Set Up An IRS Payment Plan. Updated for 2022 tax year on Aug 31 2022. Know Your Tax Bracket With Just A Few Simple Steps And Get A Head Start On Your Taxes.

The new 2018 tax brackets. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Know Your Tax Bracket With Just A Few Simple Steps And Get A Head Start On Your Taxes.

It is mainly intended for residents of the US. There are seven federal income tax rates in 2022. Your bracket depends on your taxable income and filing.

2022 Tax Calculator 01 March 2021 - 28 February 2022 Parameters. Free Tax Software Automatically Finds Your 2021 Tax Bracket to Get Your Maximum Refund. Ad Enter Your Tax Year Filing Status And Taxable Income To Calculate Your Estimated Tax Rate.

Ad Enter Your Tax Year Filing Status And Taxable Income To Calculate Your Estimated Tax Rate.

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Ready For Tax Season Federal Income Tax Guide For 2018 Financeideas Familyfinance Tax Guide Federal Income Tax Income Tax

15 Self Employment Tax Deductions In 2022 Nerdwallet Capital Gains Tax Income Tax Brackets Income Tax Return

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Tax Calculator Estimate Your Income Tax For 2022 Free

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Filing Taxes

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Sales Tax Calculator

Casio Sl797tvblack Tax Calculator In 2022 Calculator Casio Tax

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Bracket Calculator

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How To Calculate Federal Income Tax

Tax Calculation Spreadsheet In 2022 Spreadsheet Template Spreadsheet Excel Formula